The preliminary study for a potential ship retrofit hub has been submitted to the Estonian Ministry of Climate. Last week, we presented the study results and are pleased to note that there was significant interest in the study’s findings.

Study Goals and Scope

The study’s primary goal was to develop an innovative model for a shipbuilding and repair center that would also allow startup technology companies to carry out smaller projects. Additionally, the study aimed to map the capabilities of Estonia’s major ports and assess their investment needs considering the European Climate Package “Fit for 55”.

European Climate Package “Fit for 55”

The European Climate Package “Fit for 55” places pressure on shipowners and ports to reduce greenhouse gas emissions (GHG). As the retrofitting of ships and the construction of new ones gain momentum with various emerging technologies, ports face challenges in assessing their support for shipowners, particularly regarding on-shore power supply.

Currently, there is little interest from vessels to switch to shore power while at port. Various reasons, including technical ones, contribute to this, but an important observation is that the time spent in port is relatively short (between 6 and 72 hours), indicating efficient operations in Estonian ports. The survey showed that ships in the Estonian maritime area generally use laytime for supply purposes, with an average laytime of less than 72 hours.

Investment Needs for Estonian Ports

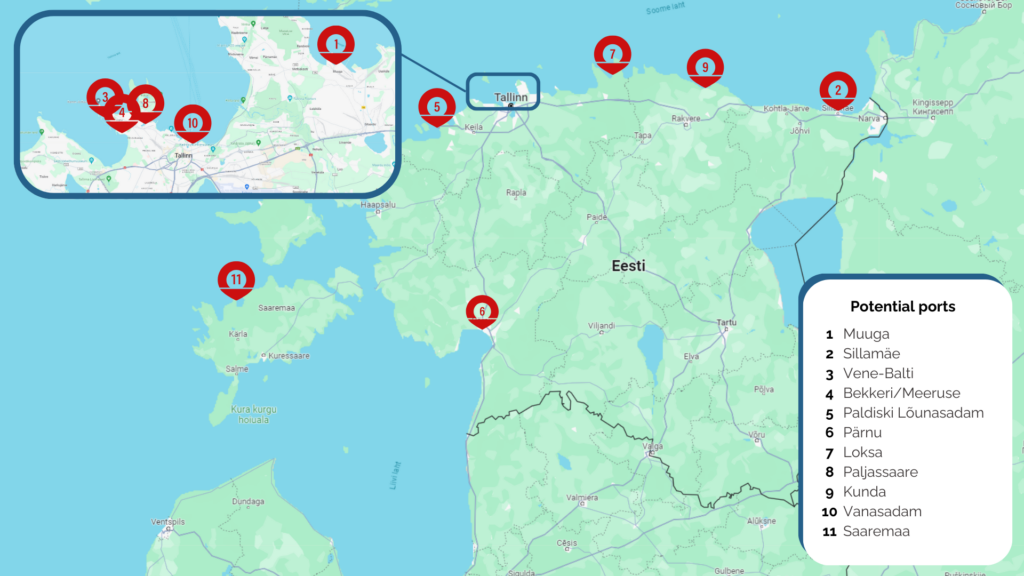

Under the current climate package agreement, the targets will be extended to the following Estonian ports: Muuga, Paldiski South Harbour, and Old City Harbour. For other ports (Bekker, Meeruse, Pärnu, Kunda, Loksa, Saaremaa, Sillamäe), the study reflects the current situation and necessary development volumes needed if the requirements are extended to them in the future.

All ports are aware of the climate package targets. While ports have made ‘green’ investments, investments specifically related to the European Climate Package have been lacking, except for Old City Harbour. Specific investment plans to meet the climate package targets have been made by the ports where the requirements already apply (Old City Harbour, Muuga, Paldiski). Other ports are taking a wait-and-see approach.

The required investment will depend on how quickly and to what extent visiting vessels become more environmentally friendly. The initial estimated investment needed to align Estonian ports with the European Climate Package is over 150 MEUR. If vessels become significantly more environmentally friendly, the need for ports to invest in developing on-shore power supply capacity will decrease. Instead, investments could be directed toward improving the supply of alternative fuels, as foreseen by the FuelEU Regulation.

Measures to Reduce Emissions

Since vessels tend to be moored in Estonian ports for short periods, the greatest environmental savings are achieved by reducing the pollution generated while vessels are in transit. The state could consider measures such as offering financial compensation to vessels flying its flag that regularly visit its ports. This approach could also support an increase in the number of vessels flying the national flag. Additionally, supporting the supply of alternative fuels would be beneficial.

Market Trends and Future Demand

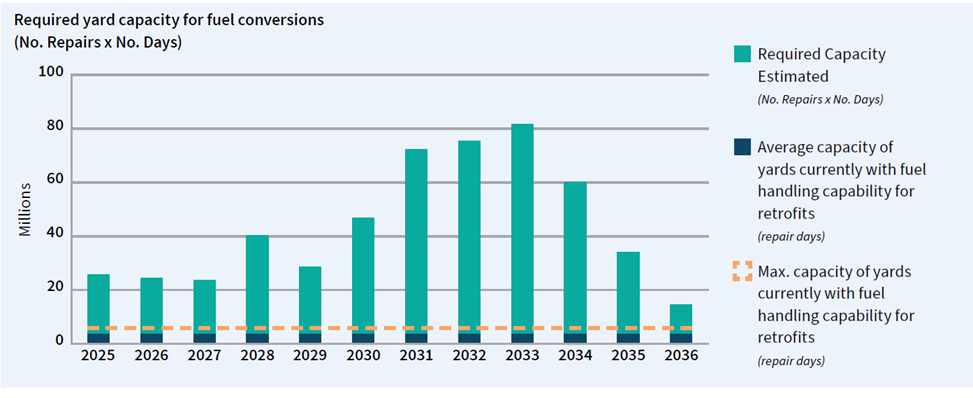

One notable trend in shipping is the switch to alternative and more environmentally friendly fuels to reduce emissions. This will create a need to retrofit and modernize existing vessels. The study indicates that there may be increased demand for retrofitting ships to methanol, ammonia, or other alternative fuels in the future.

We thoroughly analyzed the market situation and future trends in the shipbuilding and repair industry at global, European, and Baltic Sea regional levels. The maximum global potential for ship retrofitting is 9000 to 12,900 large cargo ships until 2030, after which it is assumed that all new ships will operate on zero- or near-zero carbon fuel. Even a fraction of this potential market will require significant efforts from shipyards. The integration of alternative fuel systems into existing ships requires new skills from repairers and shipbuilders.

Competitive Landscape

European shipyards focus mainly on more complex and innovative types of ships and platforms, while Asian countries like China and South Korea dominate in constructing simpler cargo ships. To remain competitive in Europe, it is crucial to maintain leadership in research, innovation, quality production, and highly skilled labor.

Impact of Military Activities and Economic Factors

The shipbuilding and rebuilding market is also affected by military activities. For example, Russia’s war against Ukraine has led to an increase in the number of ships used as “dark fleet,” where shipowners are unclear, insurance is often lacking, and the condition of the ships is questionable. Some companies in the shipping sector produce and supply to the military industry, which may delay the (re)building of new commercial vessels.

The war in Ukraine has also cast doubt on plans to use LNG, leading most shipowners to keep their options open or use ships with dual-fuel engines. Dual-fuel ships accounted for 40% of new orders as of March 2022.

Green Corridors in the Baltic Sea Region

The development of green corridors in the Baltic Sea region will create a favorable environment for establishing a ship retrofitting center in Estonia. Green corridors encourage all maritime industry parties, including fuel producers and ports, to meet environmental targets. Several Estonian ports, such as Muuga, Old City Harbour, and Sillamäe, could become hubs for reducing carbon emissions.

Estonian Shipbuilding and Repair Industry

There are over 700 shipbuilding, ship repair, ship design, and supply companies in Estonia. The largest companies include BLRT Group AS, LTH Baas AS, SRC Group AS, and Baltic Workboats AS. Many smaller companies focus on specific services and are internationally renowned. The study mapped the locations of companies across Estonia and analyzed their business models, finding high export volumes, which demonstrate the value of Estonian know-how and services internationally.

The maritime sector in Estonia includes more than 2000 companies, contributing about 4.5% to Estonia’s GDP and employing over 20,000 people. The study revealed that around 40% of the workforce in the sector will retire in the next 10 years. With one job in the shipbuilding sector leading to the creation of 10 direct and indirect positions in the supply chain, there is a need to increase investments in research and training/education systems to maintain Estonia’s high position (100th position on 15 000 comparison) in the overall international maritime competitiveness ranking.

Potential Locations for Ship Retrofitting Center

Among the potential locations for a ship retrofitting center, the ports of Muuga, Sillamäe, Vene-Balti, and Bekker/Meeruse stood out due to their good maritime transport connections and proximity to shipbuilding companies. Retrofitting operations can still be done in other ports analyzed in the study, though potentially under greater limitations. For drydocking works, services are provided by Tallinn Shipyard OÜ, Netaman Repair Group OÜ, and ARC Repair OÜ.

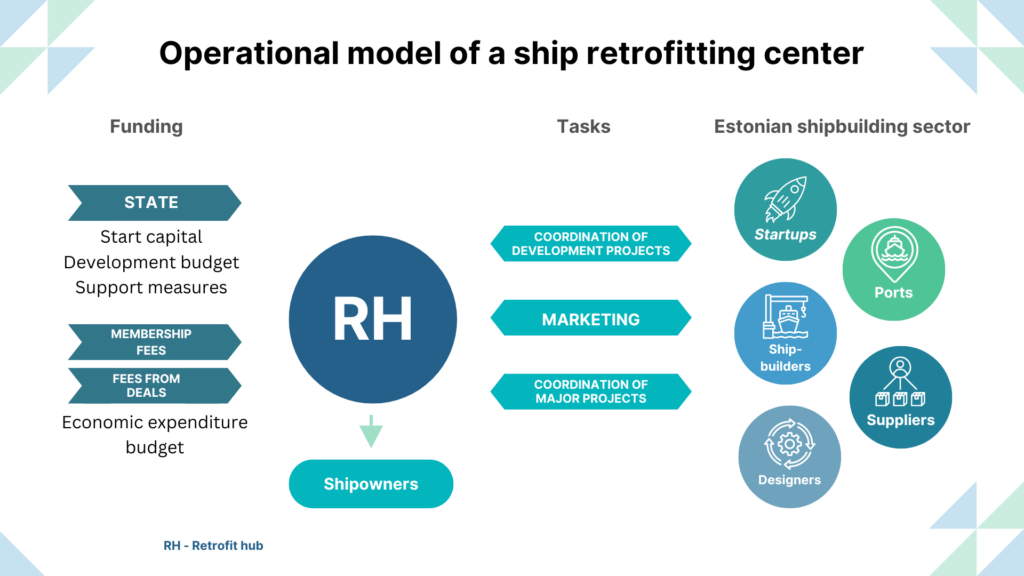

Proposed Business Model

The study proposes establishing a publicly owned/shareholding company/organization as an innovative business model for creating the ship retrofitting center. It would be worth considering bringing ship refitting companies together under one roof, offering potential customers a one-window-service option by creating a virtual ship retrofitting center rather than one or two physical locations. The center would act as a coordinator and leader, representing the interests of companies, offering joint marketing, carrying out development projects, and promoting cooperation with other sectors such as IT.

Economic Impact and Recommendations

The survey of companies showed that they see the ship retrofitting center as an opportunity to increase their turnover rather than reduce exports. Successful ship retrofitting would also increase demand for other sectors such as catering and accommodation. The study modeled the potential economic impacts under different scenarios, estimating that with the existing capacity, up to 70 million euros in tax revenue could be generated for the state per year. This can be increased by enabling research institutions and start-ups to contribute more systematically to sector development.

Main Findings and Recommendations

- The state should consider creating a virtual ship retrofitting center to offer one-window service.

- The state should create an environment that promotes cooperation between companies.

Investments in research and training/education systems should be increased to ensure a qualified workforce in the sector. - The development of port infrastructure should focus on specific capacity gaps based on market demand to recoup investments.

- A strong and well-developed marketing service and strategy is key to the success of the ship retrofitting center. The state and the organization leading the center could play a leading role.

- The focus of the ship retrofitting center could be wide-ranging, closely involving other Estonian fields of activity such as IT, robotics, etc., through systematic development projects.

In conclusion, the study indicates that Estonia has good potential to benefit from future demand in the global ship retrofitting market. The key to success is systematic cooperation with companies, the state, and other stakeholders on investments, marketing, a skilled workforce, and the development of innovative technologies and business models.

We are very grateful for the opportunity to work on the retrofit hub preliminary study and thank the Estonian Ministry of Climate and all the companies in the sector for their time and contribution to the study. The reports from the study (two in total) are available on the Ministry of Climate’s website.